Home » News & Events » Global and Regional Status of Market and Industry Development

Global and Regional Status of Market and Industry Development

The wind energy market expanded substantially in the 2000s, demonstrating the commercial and economic viability of the technology and industry, and the importance placed on wind energy development by a number of countries through policy support measures. Wind energy expansion has been concentrated in a limited number of regions, however, and wind energy remains a relatively small fraction of global electricity supply. Further expansion of wind energy, especially in regions of the world with little wind energy deployment to date and in offshore locations, is likely to require additional policy measures.

Global status and trends

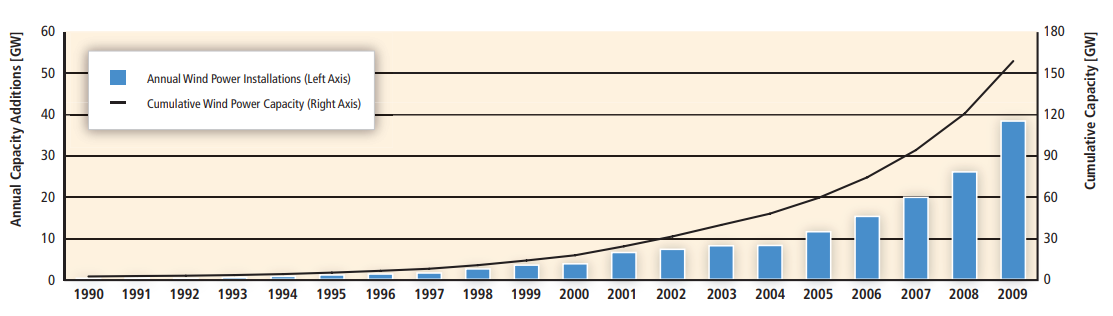

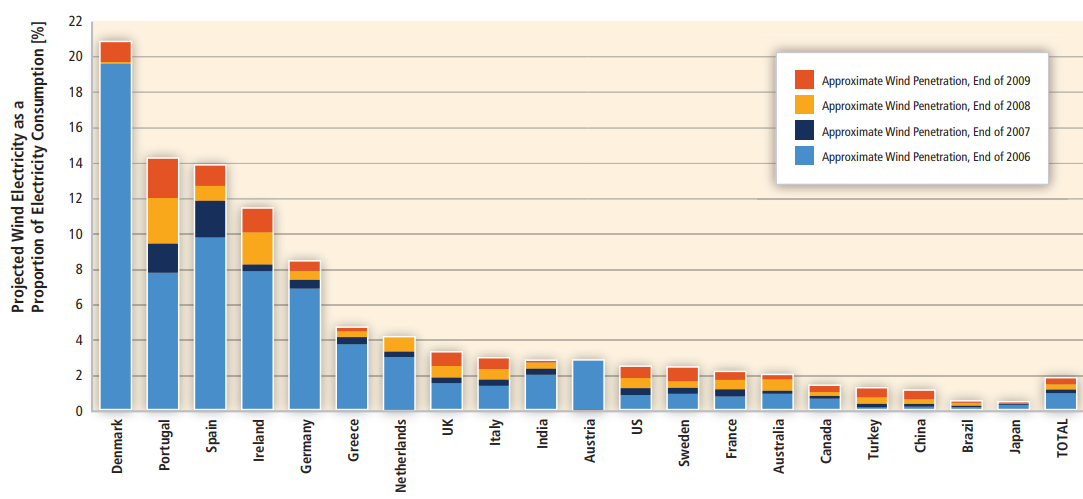

Wind energy has quickly established itself as part of the mainstream electricity industry. From a cumulative capacity of 14 GW at the end of 1999, global installed wind power capacity increased 12-fold in 10 years to reach almost 160 GW by the end of 2009, an average annual increase in cumulative capacity of 28% (see Figure 1). Global annual wind power capacity additions equaled more than 38 GW in 2009, up from 26 GW in 2008 and 20 GW in 2007.

Figure 1

The majority of the capacity has been installed onshore, with offshore installations constituting a small proportion of the total market. About 2.1 GW of offshore wind turbines were installed by the end of 2009; 0.6 GW were installed in 2009, including the first commercial offshore wind power plant outside of Europe, in China. Many of these offshore installations have taken place in the UK and Denmark. Significant offshore wind power plant development activity, however, also exists in, at a minimum, other EU countries, the USA, Canada and China. Offshore wind energy is expected to develop in a more significant way in the years ahead as the technology advances and as onshore wind energy sites become constrained by local resource availability and/or siting challenges in some regions.

The total investment cost of new wind power plants installed in 2009 was USD2005 57 billion. Direct employment in the wind energy sector in 2009 has been estimated at roughly 190,000 in the EU and 85,000 in the USA. Worldwide, direct employment has been estimated at approximately 500,000.

Despite these trends, wind energy remains a relatively small fraction of worldwide electricity supply. The total wind power capacity installed by the end of 2009 would, in an average year, meet roughly 1.8% of worldwide electricity demand, up from 1.5% by the end of 2008, 1.2% by the end of 2007, and 0.9% by the end of 2006.

Regional and national status and trends

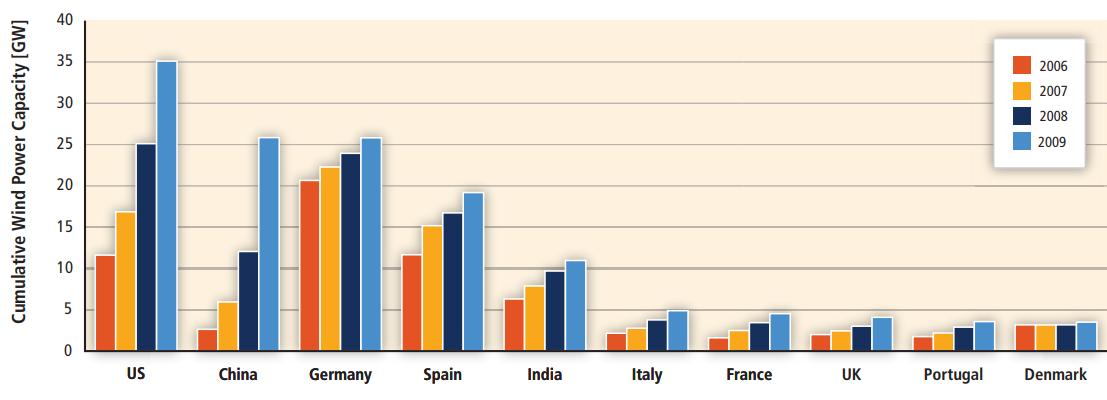

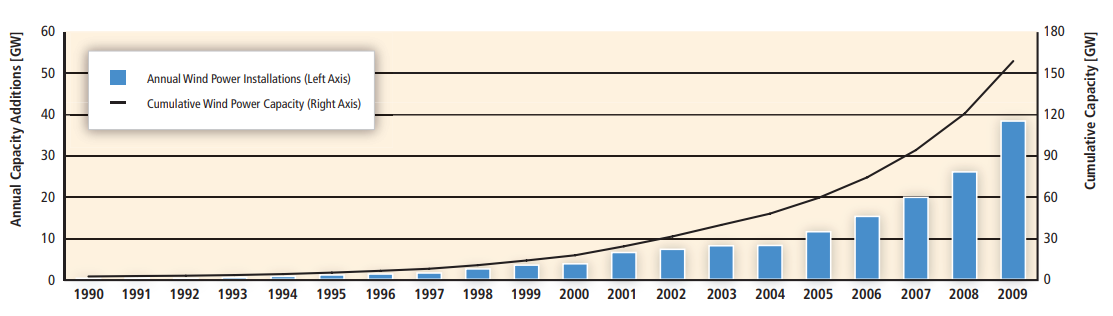

The countries with the highest total installed wind power capacity by the end of 2009 were the USA (35 GW), China (26 GW), Germany (26 GW), Spain (19 GW) and India (11 GW). After its initial start in the USA in the 1980s, wind energy growth centered on countries in the EU and India during the 1990s and the early 2000s. In the late 2000s, however, the USA and then China became the locations for the greatest annual capacity additions (Figure 2).

Figure 2

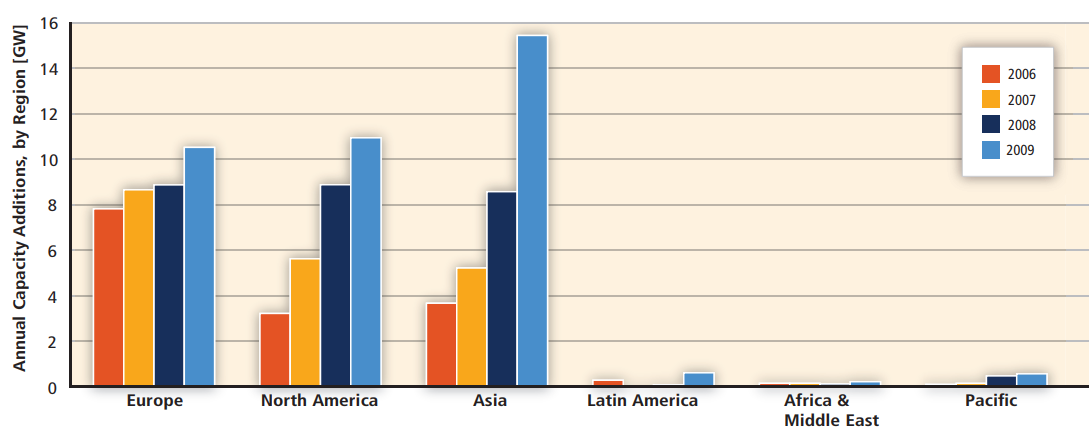

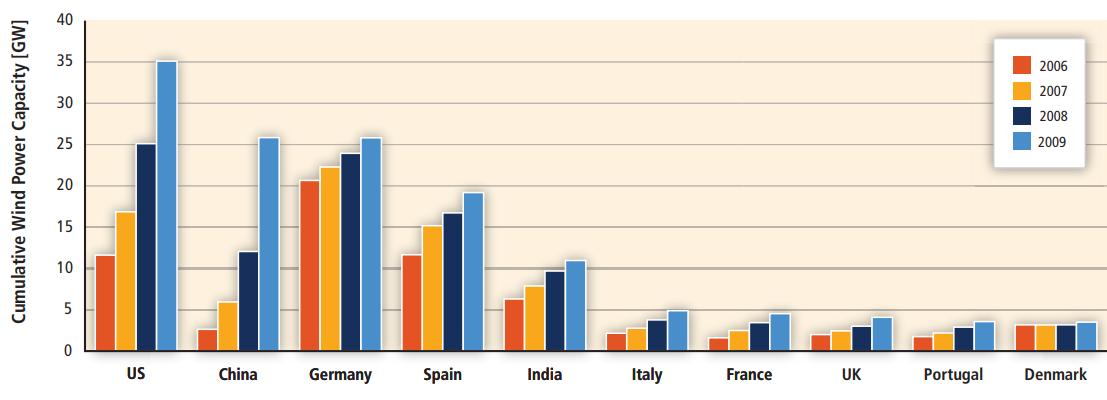

Regionally, Europe continues to lead the market with 76 GW of cumulative installed wind power capacity by the end of 2009, representing 48% of the global total (Asia represented 25%, whereas North America represented 24%). Notwithstanding the continuing growth in Europe, the trend over time has been for the wind energy industry to become less reliant on a few key markets, and other regions of the world have increasingly become the dominant markets for wind energy growth. The annual growth in the European wind energy market in 2009, for example, accounted for just 28% of the total new wind power additions in that year, down from over 60% in the early 2000s. More than 70% of the annual wind power capacity additions in 2009 occurred outside of Europe, with particularly significant growth in Asia (40%) and North America (29%) (Figure 3). Even in Europe, though Germany and Spain have been the strongest markets during the 2000s, there is a trend towards less reliance on these two countries.

Figure 3

Despite the increased globalization of wind power capacity additions, the market remains concentrated regionally. As shown in Figure 3, Latin America, Africa and the Middle East, and the Pacific regions have installed relatively little wind power capacity despite significant technical potential in each region. And, even in the regions of significant growth, most of that growth has occurred in a limited number of countries. In 2009, for example, 90% of wind power capacity additions occurred in the 10 largest markets, and 62% was concentrated in just two countries: China (14 GW, 36%) and the USA (10 GW, 26%).

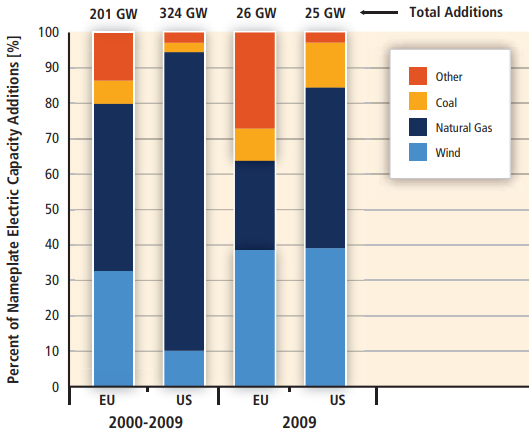

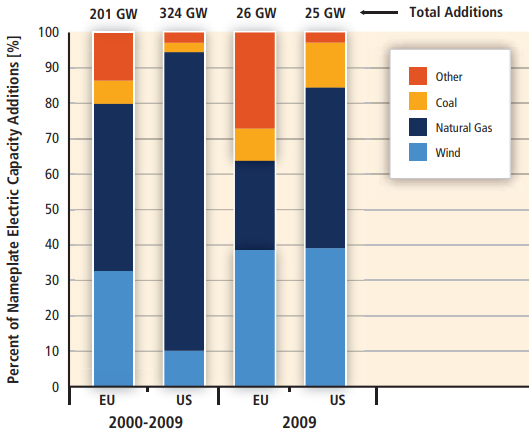

In both Europe and the USA, wind energy represents a major new source of electric capacity additions. From 2000 through 2009, wind energy was the second-largest new resource added in the USA (10% of all gross capacity additions) and EU (33% of all gross capacity additions) in terms of nameplate capacity, behind natural gas but ahead of coal. In 2009, 39% of all capacity additions in the USA and 39% of all additions in the EU came from wind energy (Figure 4). In China, 5% of the net capacity additions from 2000 to 2009 and 16% of the net additions in 2009 came from wind energy. On a global basis, from 2000 through 2009, roughly 11% of all newly installed net electric capacity additions came from new wind power plants; in 2009 alone, that figure was probably more than 20%.

Figure 4

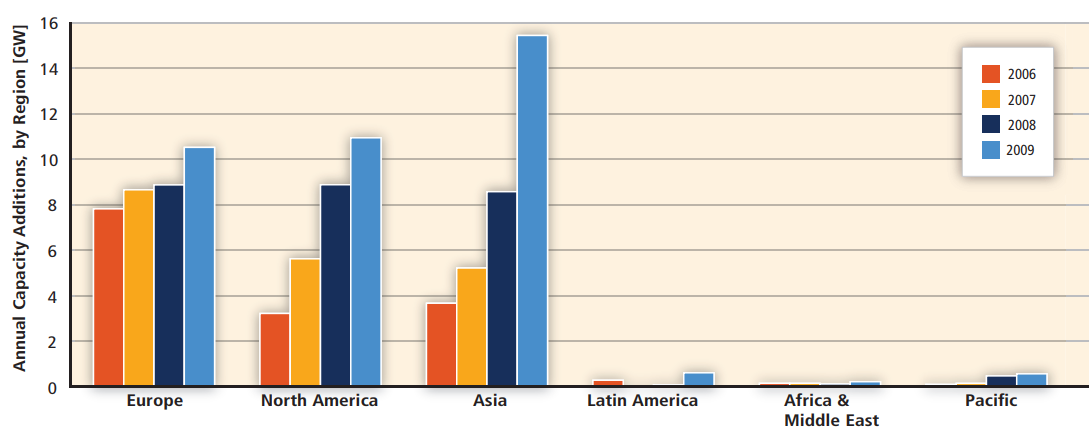

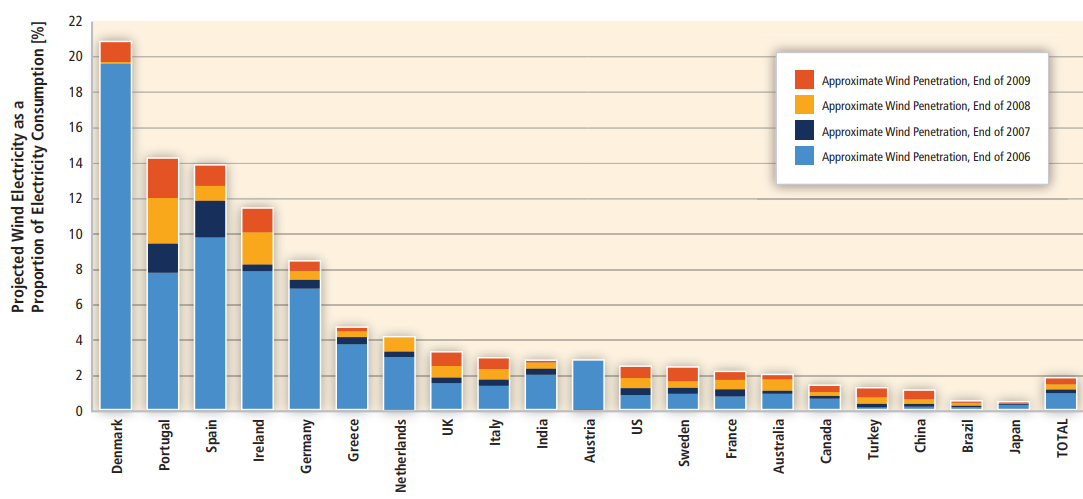

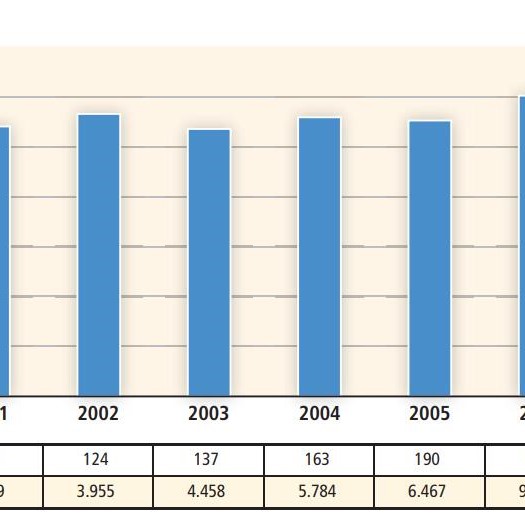

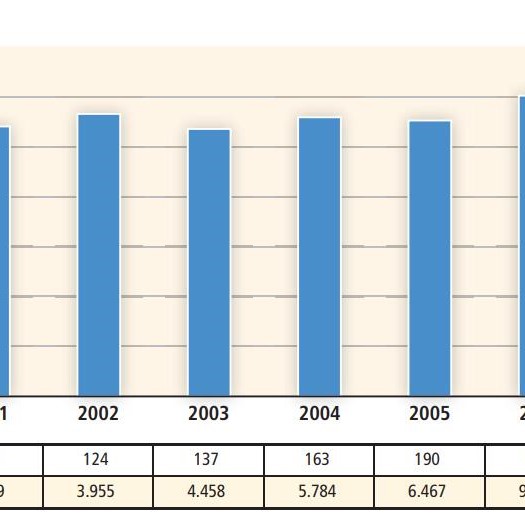

A number of countries are beginning to achieve relatively high levels of annual wind electricity penetration in their respective electric systems. Figure 5 presents data for the end of 2009 (and the end of 2006, 2007 and 2008) on installed wind power capacity, translated into projected annual electricity supply, and divided by electricity consumption. On this basis, and focusing only on the 20 countries with the greatest cumulative wind power capacity, at the end of 2009, wind power capacity was capable of supplying electricity equal to roughly 20% of Denmark’s annual electricity demand, 14% of Portugal’s, 14% of Spain’s, 11% of Ireland’s and 8% of Germany’s.

Figure 5

Industry development

The growing maturity of the wind energy sector is illustrated not only by wind power capacity additions, but also by trends in the wind energy industry. In particular, major established companies from outside the traditional wind energy industry have become increasingly involved in the sector. For example, there has been a shift in the type of companies developing, owning and operating wind power plants, from relatively small independent power plant developers to large power generation companies (including electric utilities) and large independent power plant developers. With respect to wind turbine and component manufacturing, the increase in the size and geographic spread of the wind energy market, along with manufacturing localization requirements in some countries, has brought in new players.

The involvement of these new players has, in turn, encouraged a greater globalization of the industry. Manufacturer product strategies are shifting to address larger scale power plants, higher capacity and offshore turbines, and lower wind speeds. More generally, the significant contribution of wind energy to new electric capacity investment in several regions of the world has attracted a broad range of players across the industry supply chain, from local site-focused engineering fi rms to global vertically integrated utilities. The industry’s supply chain has also become increasingly competitive as a multitude of firms seek the most profitable balance between vertical integration and specialization.

Despite these trends, the global wind turbine market remains somewhat regionally segmented, with just six countries hosting the majority of wind turbine manufacturing (China, Denmark, India, Germany, Spain and the USA). With markets developing differently, market share for turbine supply has been marked by the emergence of national industrial champions, the entry of highly focused technology innovators and the arrival of new start-ups licensing proven technology from other regions. Regardless, the industry continues to globalize: Europe’s turbine and component manufacturers have penetrated the North American and Asian markets, and the growing presence of Asian manufacturers in Europe and North America is expected to become more pronounced in the years ahead. Chinese wind turbine manufacturers, in particular, are dominating their home market, and will increasingly seek export opportunities. Wind turbine sales and supply chain strategies are therefore expected to continue to take on a more international dimension as volumes increase.

Amidst the growth in the wind energy industry also come challenges. Supply chain difficulties caused by growing demand for wind energy strained the industry, and prices for wind turbines and turbine components increased to compensate for this imbalance. Commodity price increases, the availability of skilled labor and other factors also played a role in pushing wind turbine prices higher, while the underdeveloped supply chain for offshore wind power plants strained that portion of the industry.

Overcoming supply chain difficulties is not simply a matter of ramping up the production of wind turbine components to meet the increased levels of demand. Large-scale investment decisions are more easily made based on a sound long-term outlook for the industry. In most markets, however, both the projections and actual demand for wind energy depend on a number of factors, some of which are outside of the control of the industry, such as political frameworks and policy measures.

Global status and trends

Wind energy has quickly established itself as part of the mainstream electricity industry. From a cumulative capacity of 14 GW at the end of 1999, global installed wind power capacity increased 12-fold in 10 years to reach almost 160 GW by the end of 2009, an average annual increase in cumulative capacity of 28% (see Figure 1). Global annual wind power capacity additions equaled more than 38 GW in 2009, up from 26 GW in 2008 and 20 GW in 2007.

Figure 1

The majority of the capacity has been installed onshore, with offshore installations constituting a small proportion of the total market. About 2.1 GW of offshore wind turbines were installed by the end of 2009; 0.6 GW were installed in 2009, including the first commercial offshore wind power plant outside of Europe, in China. Many of these offshore installations have taken place in the UK and Denmark. Significant offshore wind power plant development activity, however, also exists in, at a minimum, other EU countries, the USA, Canada and China. Offshore wind energy is expected to develop in a more significant way in the years ahead as the technology advances and as onshore wind energy sites become constrained by local resource availability and/or siting challenges in some regions.

The total investment cost of new wind power plants installed in 2009 was USD2005 57 billion. Direct employment in the wind energy sector in 2009 has been estimated at roughly 190,000 in the EU and 85,000 in the USA. Worldwide, direct employment has been estimated at approximately 500,000.

Despite these trends, wind energy remains a relatively small fraction of worldwide electricity supply. The total wind power capacity installed by the end of 2009 would, in an average year, meet roughly 1.8% of worldwide electricity demand, up from 1.5% by the end of 2008, 1.2% by the end of 2007, and 0.9% by the end of 2006.

Regional and national status and trends

The countries with the highest total installed wind power capacity by the end of 2009 were the USA (35 GW), China (26 GW), Germany (26 GW), Spain (19 GW) and India (11 GW). After its initial start in the USA in the 1980s, wind energy growth centered on countries in the EU and India during the 1990s and the early 2000s. In the late 2000s, however, the USA and then China became the locations for the greatest annual capacity additions (Figure 2).

Figure 2

Regionally, Europe continues to lead the market with 76 GW of cumulative installed wind power capacity by the end of 2009, representing 48% of the global total (Asia represented 25%, whereas North America represented 24%). Notwithstanding the continuing growth in Europe, the trend over time has been for the wind energy industry to become less reliant on a few key markets, and other regions of the world have increasingly become the dominant markets for wind energy growth. The annual growth in the European wind energy market in 2009, for example, accounted for just 28% of the total new wind power additions in that year, down from over 60% in the early 2000s. More than 70% of the annual wind power capacity additions in 2009 occurred outside of Europe, with particularly significant growth in Asia (40%) and North America (29%) (Figure 3). Even in Europe, though Germany and Spain have been the strongest markets during the 2000s, there is a trend towards less reliance on these two countries.

Figure 3

Despite the increased globalization of wind power capacity additions, the market remains concentrated regionally. As shown in Figure 3, Latin America, Africa and the Middle East, and the Pacific regions have installed relatively little wind power capacity despite significant technical potential in each region. And, even in the regions of significant growth, most of that growth has occurred in a limited number of countries. In 2009, for example, 90% of wind power capacity additions occurred in the 10 largest markets, and 62% was concentrated in just two countries: China (14 GW, 36%) and the USA (10 GW, 26%).

In both Europe and the USA, wind energy represents a major new source of electric capacity additions. From 2000 through 2009, wind energy was the second-largest new resource added in the USA (10% of all gross capacity additions) and EU (33% of all gross capacity additions) in terms of nameplate capacity, behind natural gas but ahead of coal. In 2009, 39% of all capacity additions in the USA and 39% of all additions in the EU came from wind energy (Figure 4). In China, 5% of the net capacity additions from 2000 to 2009 and 16% of the net additions in 2009 came from wind energy. On a global basis, from 2000 through 2009, roughly 11% of all newly installed net electric capacity additions came from new wind power plants; in 2009 alone, that figure was probably more than 20%.

Figure 4

A number of countries are beginning to achieve relatively high levels of annual wind electricity penetration in their respective electric systems. Figure 5 presents data for the end of 2009 (and the end of 2006, 2007 and 2008) on installed wind power capacity, translated into projected annual electricity supply, and divided by electricity consumption. On this basis, and focusing only on the 20 countries with the greatest cumulative wind power capacity, at the end of 2009, wind power capacity was capable of supplying electricity equal to roughly 20% of Denmark’s annual electricity demand, 14% of Portugal’s, 14% of Spain’s, 11% of Ireland’s and 8% of Germany’s.

Figure 5

Industry development

The growing maturity of the wind energy sector is illustrated not only by wind power capacity additions, but also by trends in the wind energy industry. In particular, major established companies from outside the traditional wind energy industry have become increasingly involved in the sector. For example, there has been a shift in the type of companies developing, owning and operating wind power plants, from relatively small independent power plant developers to large power generation companies (including electric utilities) and large independent power plant developers. With respect to wind turbine and component manufacturing, the increase in the size and geographic spread of the wind energy market, along with manufacturing localization requirements in some countries, has brought in new players.

The involvement of these new players has, in turn, encouraged a greater globalization of the industry. Manufacturer product strategies are shifting to address larger scale power plants, higher capacity and offshore turbines, and lower wind speeds. More generally, the significant contribution of wind energy to new electric capacity investment in several regions of the world has attracted a broad range of players across the industry supply chain, from local site-focused engineering fi rms to global vertically integrated utilities. The industry’s supply chain has also become increasingly competitive as a multitude of firms seek the most profitable balance between vertical integration and specialization.

Despite these trends, the global wind turbine market remains somewhat regionally segmented, with just six countries hosting the majority of wind turbine manufacturing (China, Denmark, India, Germany, Spain and the USA). With markets developing differently, market share for turbine supply has been marked by the emergence of national industrial champions, the entry of highly focused technology innovators and the arrival of new start-ups licensing proven technology from other regions. Regardless, the industry continues to globalize: Europe’s turbine and component manufacturers have penetrated the North American and Asian markets, and the growing presence of Asian manufacturers in Europe and North America is expected to become more pronounced in the years ahead. Chinese wind turbine manufacturers, in particular, are dominating their home market, and will increasingly seek export opportunities. Wind turbine sales and supply chain strategies are therefore expected to continue to take on a more international dimension as volumes increase.

Amidst the growth in the wind energy industry also come challenges. Supply chain difficulties caused by growing demand for wind energy strained the industry, and prices for wind turbines and turbine components increased to compensate for this imbalance. Commodity price increases, the availability of skilled labor and other factors also played a role in pushing wind turbine prices higher, while the underdeveloped supply chain for offshore wind power plants strained that portion of the industry.

Overcoming supply chain difficulties is not simply a matter of ramping up the production of wind turbine components to meet the increased levels of demand. Large-scale investment decisions are more easily made based on a sound long-term outlook for the industry. In most markets, however, both the projections and actual demand for wind energy depend on a number of factors, some of which are outside of the control of the industry, such as political frameworks and policy measures.

Post a Comment:

You may also like:

Featured Articles

Economic Impacts of Wind Industry

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...

Any business development will have economic impacts on the local and regional economies, and wind energy projects are no ...Challenges in Wind Industry

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...

While wind power generation offers numerous benefits and advantages over conventional power generation, there are also some ...Environmental Impacts of Wind Industry

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...

In recent years, the growth of capacity to generate electricity from wind energy has been extremely rapid, To the ...Employment Impacts of Wind Industry

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...

As with most construction and commercial development, wind energy industry create jobs. According to the 2016 Clean Jobs New ...Wind Energy Cost Trends

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...

Though the cost of wind energy has declined significantly since the 1980s, policy measures are currently required to ensure ...